Employers

A Section 125 plan is an employer‐sponsored fringe benefit plan that is subject to the federal Internal Revenue Code Section 125. Some of the common names for this type of plan are cafeteria plan, flexible benefits plan, flex plan, and flexible spending arrangement.

Employer contributions that are considered IPERS‐covered wages are those contributions made to a Section 125 plan that can be received in cash or used to purchase benefits.

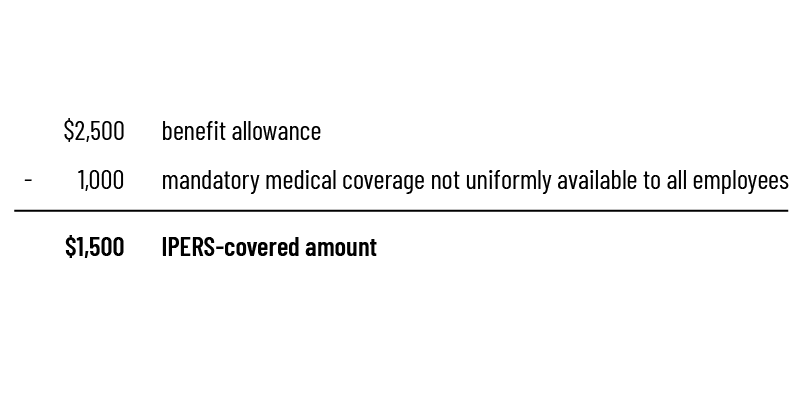

- The employer contributions must be uniformly available. Iowa Code section 97B.1A(26)(a)(1)(b) states that elective employer contributions shall be treated as covered wages only if made uniformly available and not limited to highly compensated employees.

- See the Employer Handbook (PDF, 10.75 KB), Section 4 (IPERS‐Covered Wages and Compensation), for a full discussion of coverage rules related to Section 125 plans.

- Employer contributions that must be used to purchase benefits under a Section 125 plan (e.g., where the employee has no choice to take in cash) cannot be IPERS‐covered wages.

Employers offering employer contributions to a fringe benefit plan must certify that their Section 125 plan meets all IRC requirements. Employer contributions to fringe benefit plans that have not been certified will be excluded from IPERS coverage.

Proceed with Caution

Section 125 plans are complex. If you are unsure which wages should be covered, submit your plan documents to IPERS for review.

Example

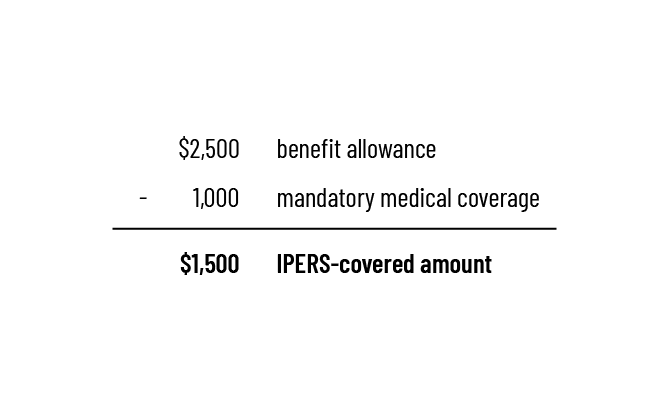

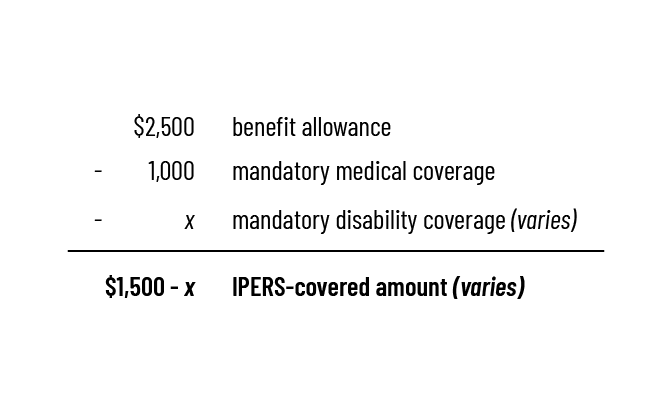

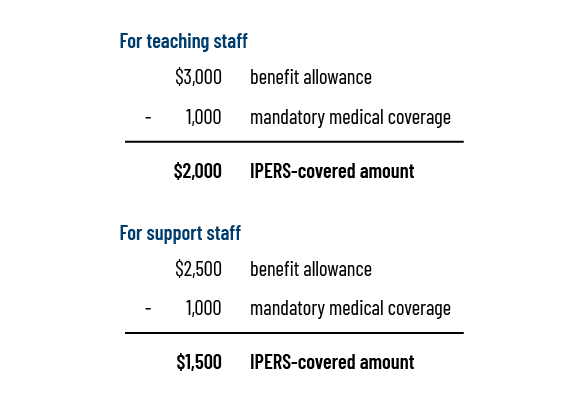

An organization provides a benefit allowance in addition to all employees’ regular salaries for the employees to purchase Section 125 benefits with or take as cash. The benefit allowance is $2,500, except where noted below. The employees may use this allowance to pay for any combination of benefits (including participation in flexible spending accounts).

The organization requires all employees to purchase, at a minimum, single employee medical coverage for $1,000.

My Account Login

My Account Login