As you prepare for this significant milestone, it's important to know what makes you eligible for IPERS retirement benefits, the steps you need to take and when to file an application for retirement benefits.

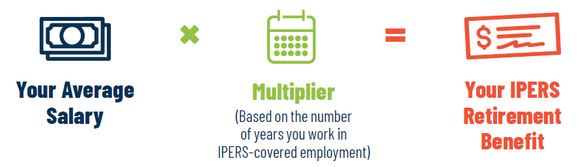

Details on applying for retirement, preparing for retirement and purchasing service credits are in the menu on the right. Information on how retirement benefits are calculated can be found on this page.

Regular members

You are eligible for retirement benefits if you are a vested member, are no longer working for an IPERS-covered employer and meet one of these conditions:

- You are at least 55 years old.

- You retire because of a disability and are receiving Social Security disability or Railroad Retirement disability benefits.

- You are age 70 and still working for an IPERS-covered employer, which means that you may apply for benefits while still employed. When you stop working, IPERS may adjust your benefit to account for your additional years of service and salary. You must apply for a recalculation when you stop working.

Early retirement

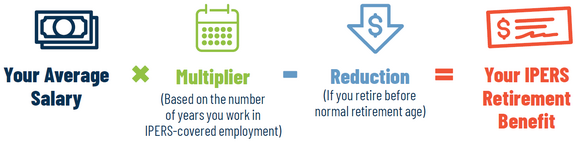

If you retire before normal retirement age and you do not retire because of a disability, you will receive a lower benefit. The reduction makes up for the increased time you will collect benefits.

Normal retirement age

Normal retirement age, when an early-retirement reduction no longer applies, is one of the following, whichever comes first:

- Your years of service plus your age at your last birthday equals or exceeds 88 (Rule of 88).

- Age 62 if you have 20 or more years of service (Rule of 62/20).

- Age 65.

For service through June 30, 2012, the reduction is 3% for each year (or 0.25% for each month) you receive benefits before your closest normal retirement age.

For service earned starting July 1, 2012, the reduction increases to 6% times the number of years (or 0.50% times the number of months) you receive benefits before your 65th birthday.

Early-retirement benefit reductions apply only if you retire before normal retirement age.

- The 3% reduction applies to all service before July 1, 2012.

- The 6% reduction applies only to service after June 30, 2012.

Sheriffs/Deputy Sheriffs Members

You are eligible for retirement benefits if you are a vested member, are no longer working for an IPERS-covered employer and meet one of these conditions:

- You are at least 50 years old with at least 22 years of eligible service. In addition, you must be a sheriff or deputy sheriff when you end IPERS-covered employment. Eligible service includes time worked in Sheriffs/Deputy Sheriffs or Protection Occupations groups.

- You are at least 55 years old.

- You retire because of a disability and are eligible for Regular disability benefits or Special Service disability benefits.

Protection Occupations Members

You are eligible for retirement benefits if you are a vested member, are no longer working for an IPERS-covered employer and meet one of these conditions:

- You are at least 55 years old.

- You retire because of a disability and are eligible for Regular disability benefits or Special Service disability benefits.