Employers

Many IPERS retirees go back to work with an IPERS-covered employer after retiring – and continue to receive IPERS retirement benefits. Iowa law governs the circumstances under which this is allowed.

While it is the employee’s responsibility to comply with the law, it is important for employers to know the regulations associated with a retiree’s return to work. Employers that knowingly reemploy a retiree in violation of the bona fide retirement law may be criminally prosecuted for engaging in a fraudulent practice.

Requirements

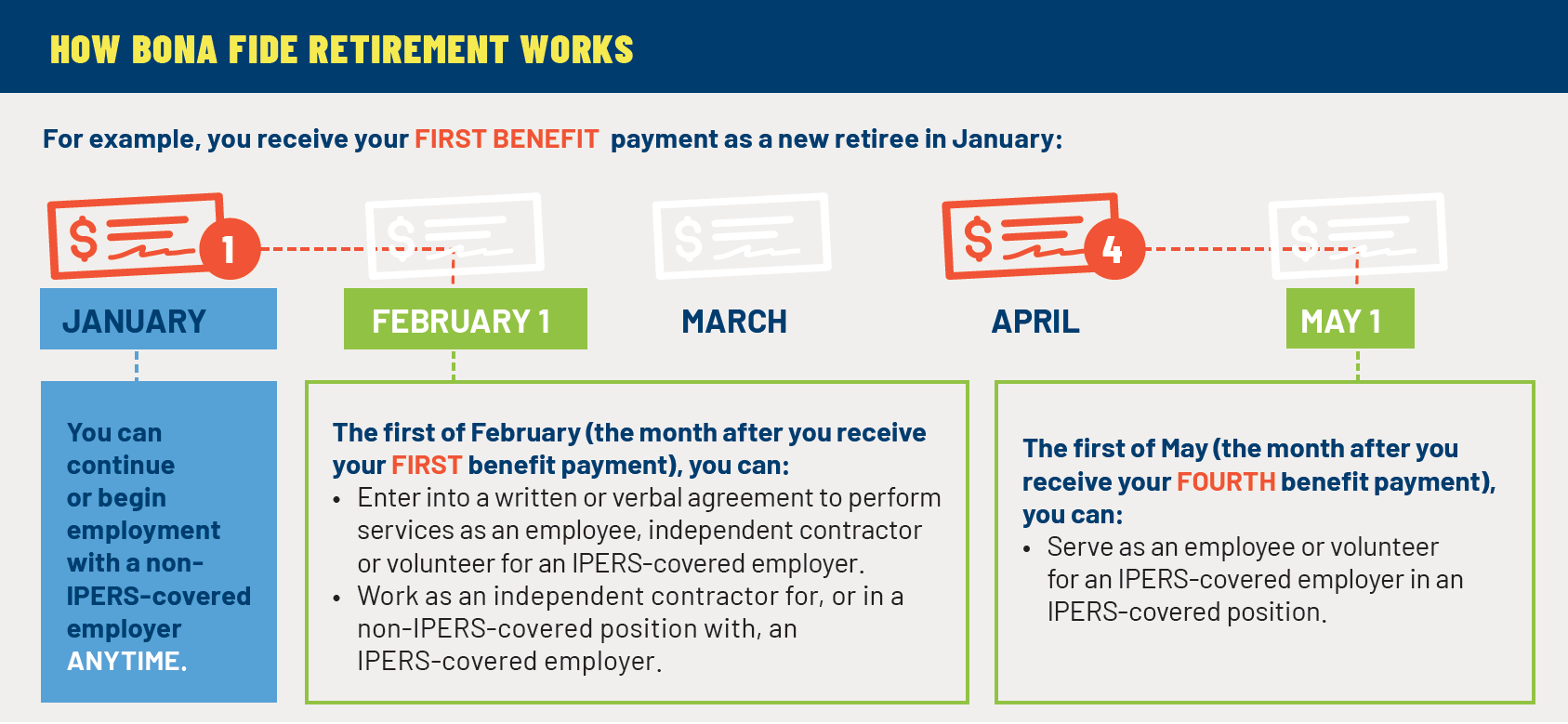

A retiree under age 70 must have a bona fide retirement before returning to IPERS-covered employment. The bona fide retirement period goes from the beginning of the month a retiree receives the first retirement check (known as the “first month of entitlement”) to the end of the month the retiree receives the fourth retirement check.

The qualification period begins with the first month of entitlement for retirement benefits as approved by IPERS.

A retiree cannot enter into reemployment or independent contracting agreements, either written or verbal, before receiving at least one benefit payment from IPERS. A retiree cannot work as an independent contractor for, or in a non-IPERS-covered position with, an IPERS-covered employer before receiving at least one benefit payment from IPERS. A retiree may accept temporary employment after the first month of entitlement in their previous position.

However, reemployment in a previous position can’t be used as a means of evading the bona fide retirement rules.

If IPERS learns the retiree was hired as a temporary employee during the bona fide retirement period, and then, for whatever reason, the employer treats the retiree as a covered employee immediately following the bona fide retirement period, IPERS will perform an audit. If IPERS learns the employer did not make reasonable efforts to fill the vacancy left by the retiree, IPERS will revoke the retiree’s benefits.

Exceptions

- Working for a covered employer after age 70

If a retiree is older than age 70, they may receive IPERS benefits while working for an IPERS-covered employer. After they end employment with an IPERS-covered employer, the retiree should contact IPERS and apply for a recomputation of benefits. - Licensed Teachers

Bona Fide Retirement requirements may be different for retirees who return to work as licensed teachers. Visit our Licensed Teachers page to learn more. - Iowa National Guard members

Retirees may be called to state duty during the bona fide retirement period without any benefit penalty. - Part-time elected officials

Retirees may start receiving benefits while in office. When they intend to retire, part-time elected officials should notify IPERS in writing of their intent to end all covered employment and end IPERS coverage for their elected position.

My Account Login

My Account Login