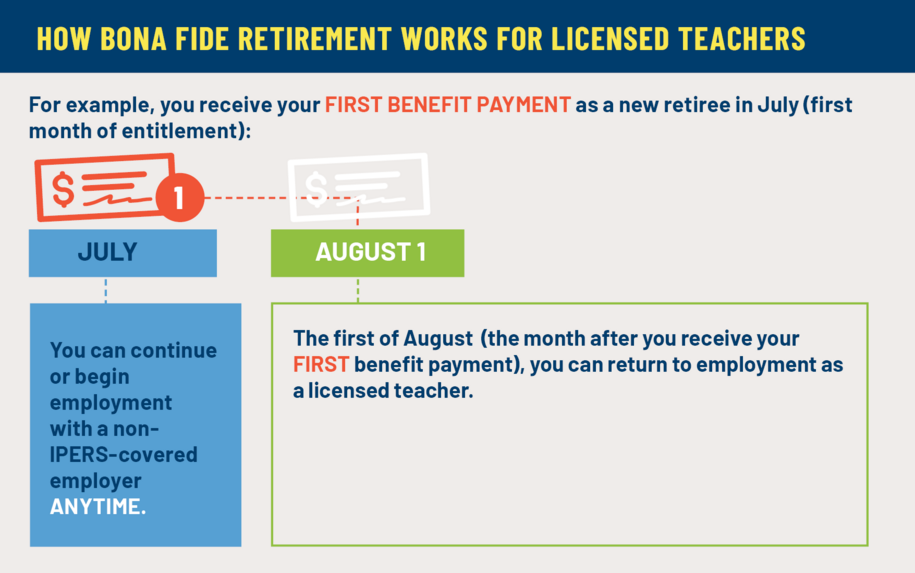

In March 2024, Governor Reynolds signed legislation that shortens the Bona Fide Retirement requirement from four months to one month only for members who retire between July 1, 2024 and June 30, 2027, and return to work as a licensed teacher. Use the frequently asked questions below to understand the implications of the law.

Did the governor sign legislation that changes the Bona Fide Retirement requirement?

Yes. In March 2024, Governor Reynolds signed HF 2612 that shortens the Bona Fide Retirement requirement from four months to one month only for members who retire between July 1, 2024, and June 30, 2027, and return to work as a licensed teacher.

What is Bona Fide Retirement?

As a public pension plan, IPERS is subject to IRS regulations and guidelines. Among them is the requirement that people who retire from a public pension system have a true separation before they may return to work and contribute to another pension. In Iowa, most retirees must receive four retirement benefit payments before they may return to work for any IPERS-covered employer in any IPERS-covered position.

Who is eligible to take advantage of the shortened Bona Fide Retirement period?

Only members who retire between July 1, 2024, and June 30, 2027, and return to work as a licensed teacher may take advantage of the shortened Bona Fide Retirement period. IPERS members who return to work as anything other than a licensed teacher or retire anytime other than between July 1, 2024, and June 30, 2027, are subject to the standard Bona Fide Retirement requirements.

When is the shortened Bona Fide Retirement period effective?

The shortened Bona Fide Retirement is effective July 1, 2024. IPERS members who receive their first retirement benefit payment prior to July 1, 2024, are subject to standard Bona Fide Retirement requirements.

When does the shortened Bona Fide Retirement period end?

Beginning July 1, 2027, standard Bona Fide Retirement requirements will apply to all IPERS members.

Who is considered a licensed teacher?

Employers will decide which positions require a licensed teacher.

Are temporary employees eligible to take advantage of the shortened BFR period?

The BFR rules for temporary employees that must qualify for IPERS remain unchanged. A retiree may return as a temporary employee (including a substitute teacher) after receiving their first benefit payment. In many cases, school districts do not cover temporary employees until they qualify for IPERS by earning $1,000 or more in wages for two consecutive calendar quarters.

When can I return to work as a substitute teacher?

If the substitute position requires a licensed teacher and the employer defines all substitutes as permanent employees, eligible retirees may take advantage of the shortened Bona Fide Retirement period. If the substitute position does not require a licensed teacher, or if the employer defines substitute teachers as temporary employees, the standard Bona Fide Retirement requirements apply.

When can I return to work as a coach?

The shortened Bona Fide Retirement period does not include citizen coaches. A citizen coach is a school district employee who works as a coach only. Regardless of whether the school district defines citizen coaches as temporary or permanent employees, citizen coaches must observe the standard Bona Fide Retirement period.

Members who work as an IPERS-covered coach and in any other IPERS-covered position must resign from both positions to achieve a true separation from IPERS-covered employment. The member may return to work as an IPERS-covered licensed teacher after one month but may not be eligible to return as a citizen coach for four months. IPERS members should check with their school district about whether it considers citizen coaches temporary or permanent employees.

Before I retire, can I coordinate with my current employer or with a different IPERS-covered employer to return to work?

No. The IRS requires people who retire from a public pension plan to have a true separation from employment. A pre-arranged agreement – either verbal or written - to return to work for any IPERS-covered employer in an IPERS-covered position is not a true separation and violates the IRS’ guidelines.

What happens if I violate Bona Fide Retirement guidelines?

IPERS audits job postings and wage reporting dates. Members who violate the IRS’ Bona Fide Retirement guidelines will lose retirement benefits and be required to repay their retirement benefits with interest.

What if I want to go to work for a different IPERS-covered employer?

All Bona Fide Retirement requirements apply to any IPERS-covered employer.

Does the shortened Bona Fide Retirement period impact the $50,000 annual earnings limit?

No. By law, IPERS members who return to work in an IPERS-covered position for an IPERS-covered employer after any period of separation may not earn more than $50,000 per calendar year. Retirees who violate this earnings limit will be required to repay a portion of their retirement benefit.

What if I want to return to work for a regent institution?

Employees of regent institutions may choose IPERS or a defined contribution plan. Regardless of the plan you choose, you cannot return to work at a regent institution until after you have received one retirement benefit payment.