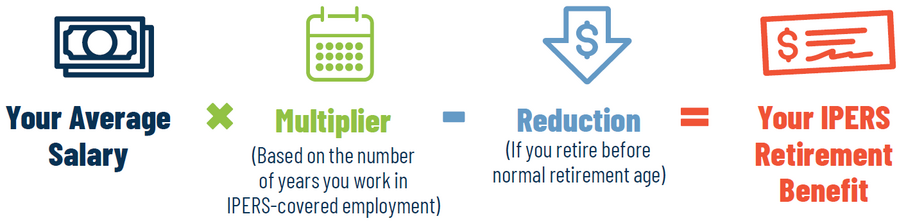

Formula

Your IPERS retirement benefit is calculated using this formula:

Your average salary x a multiplier based on the number of years you work in IPERS-covered employment minus a reduction if you retire before your normal retirement age.

Average salary

This is the average of your highest five years' salaries. These don't have to be the five years that immediately precede your retirement.

Wage spiking

When calculating your benefit, IPERS tests for wage spiking, to prevent overpaying your benefits. Your average salary will be decreased if wage spiking occurred.

- To test our highest three-year average salary for wage spiking, IPERS compares it to a “control-year salary” (your highest calendar year’s salary outside of the three salaries making up your highest three-year average). If your highest three-year average salary is more than 121% of your control-year salary, your salary in the benefit formula will be reduced to 121% of your control-year salary. Additional rules apply when your control-year salary does not represent a full year of salary.

- To test your highest five-year average salary for wage spiking, IPERS compares it to a “control-year salary” (your highest calendar year’s salary outside of the five salaries making up your highest five-year average). If your highest five-year average salary is more than 134% of your control-year salary, your salary in the benefit formula will be reduced to 134% of your control-year salary.

IPERS will review your wages if you stop working before the end of a calendar year. To calculate your wages, we will:

- Look at the wages you earned in each quarter of your last year of employment.

- Look at your highest calendar year wage not used in the average salary calculation and calculate the average quarterly wage for that year.

- Use the amount calculated in Step 2 for the quarters you did not work in your last year and add up the amounts for all four quarters. This is called your computed-year wage.

If the computed-year wage is more than your third-highest (or fifth-highest) calendar year wage, then the computed-year wage is used as your final year’s wage. (The computed-year wage is limited to 103% of your highest calendar year wage. This calculation will not result in additional service credit.)

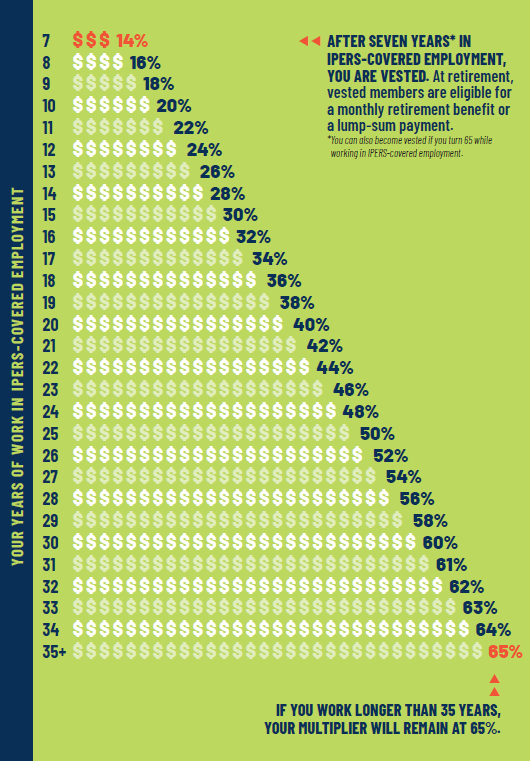

Multiplier

This increases two percentage points each year you work in IPERS' covered employment up to year 30. From year 31 to 35, the multiplier increases on percentage point each year. The maximum multiplier is 65% at 35 years in covered employment.

At retirement you may "purchase service" - or buy work time - to increase your multiplier.

Reduction

A reduction is applied if you retire before you reach a normal retirement age. IPERS will reduce your retirement benefit by 0.5% for each month (or 6% annually) that you receive retirement benefits before age 65.