This page provides additional information and resources for Federal Form W-4P. IPERS staff is prohibited from providing tax advice. Contact the Internal Revenue Service (IRS) or your tax professional with questions about the taxability of your benefits and the completion of any tax-related forms.

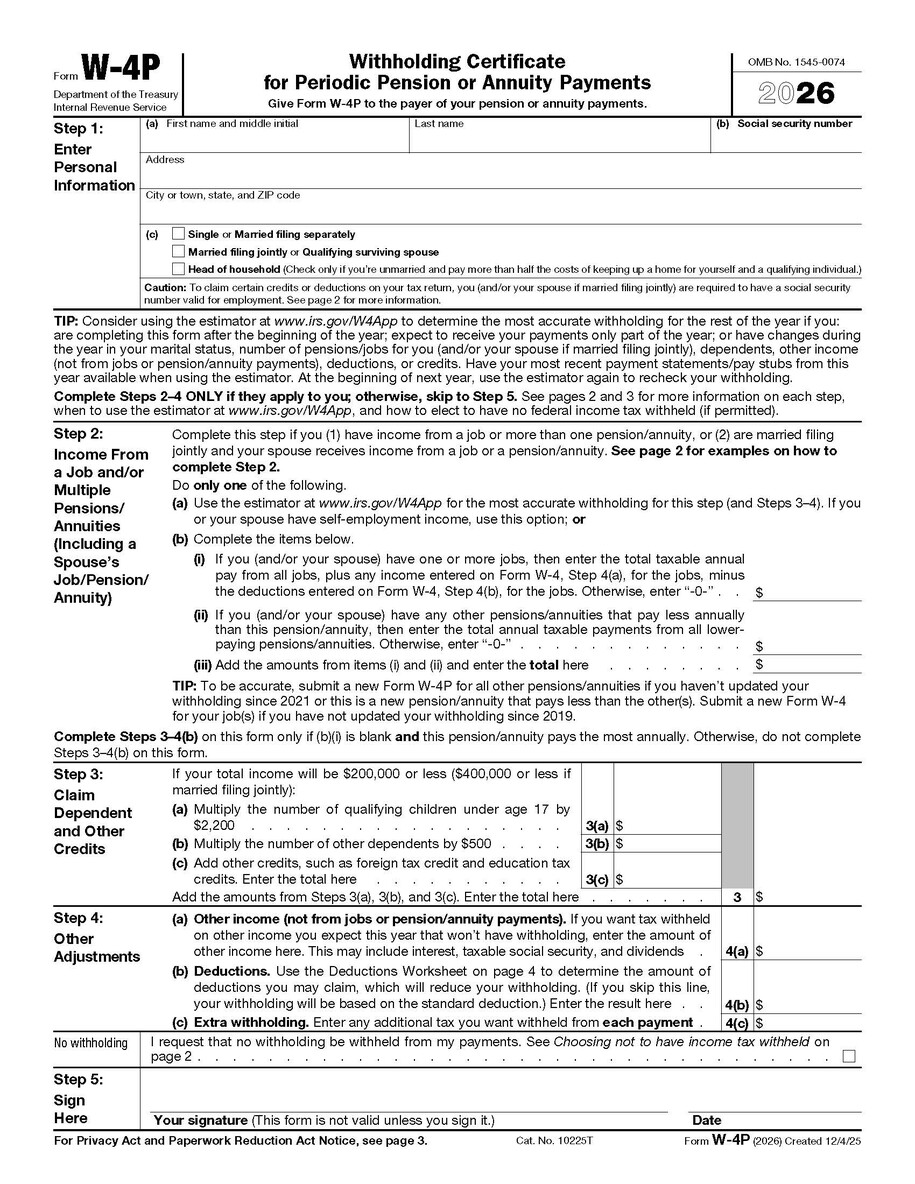

All IPERS retirees complete a Form W-4P as part of their retirement application but can change withholdings at any time. Download the Form W-4P (126.85 KB) Archived .pdf or access the form via the IRS’ website. Please submit a new Form W-4P each time you need to adjust your federal income tax withholding.

Withholdings

IPERS will not implement a Form W-4P unless it is properly completed and received before benefit payments occur. IPERS will use the default rate for withholdings for anyone who does not complete the form, or whose form cannot be processed as part of the retirement application.

- Default Withholding: Your default federal income tax withholding rate for benefit payments is single with 0 (zero) adjustments.

- Changing from the Default Withholding: Use the W-4P to change your federal income tax withholding and/or to set an additional amount to be withheld from your benefit payments.

- Multiple Benefit Payments: If you receive multiple benefit payments from IPERS, write a note in the top margin of the Form W4-P to specify which benefit(s) the Form W-4P applies to.

Form W4-P guidelines

The information below can be used as a guide for completing Federal Form W-4P.

| Requirement | Step | Instructions |

|---|---|---|

| Required | Step 1: Personal Information | Enter your (a) name, address, (b) social security number and (c) anticipated tax filing status (check only one). Step 1 (c) determines the standard deduction and tax rates used to compute your withholding. After completing Step 1, you may skip to Step 5. |

| Optional | Step 2: Income Consideration | Consider completing this step if: (a) you have income from a job, or (b) you have more than one pension, or (c) you file jointly and your spouse works or has a pension. |

| Optional | Step 3: Claim Dependents and Other Credits | Consider completing this step to claim credits. |

| Optional | Step 4: Other Adjustments | -If you wish to have tax withheld on other income that won't have tax withheld, you may report it on line 4(a). -If you do not claim the standard deduction and want to reduce your withholding, you may report other deductions on line 4(b). -If you want additional federal tax withheld each month, enter that amount on line 4(c). -You may elect to have NO federal tax withheld from your monthly benefit by writing "No Withholding" in the space below Step 4(c) and completing steps 1(a), 1(b) and 5. Caution: You could owe taxes and penalties when you file your income tax return if you have too little tax withheld. |

| Required | Step 5: Signature Block | Sign and date the Form W-4P. |

| Required | Finalize | Please return the completed Form W-4P to IPERS along with any other necessary forms or documents. |