This page provides additional information and resources for Form 1099-R. IPERS staff is prohibited from providing tax advice. Contact the Internal Revenue Service (IRS) or your tax professional with questions about the taxability of your benefits and the completion of any tax-related forms.

According to federal law, annually IPERS must mail a Form 1099-R to anyone who received a benefit during the previous calendar year. This form reports the income you received from IPERS and is necessary to complete your federal and state tax returns.

How do I access my Form 1099-R?

The Internal Revenue Service (IRS) requires payers to mail the Form 1099-R no later than January 31. Depending on the date that Form 1099-R is mailed, you may not receive your form until early February. Please contact IPERS if you have not received the form by early February.

Additionally, all documents, statements and letters – including the Form 1099-R – are available in My Account, your IPERS retirement toolkit. Often, the digital version of the Form 1099-R is available before the print version is mailed. Members who have logged in to My Account will receive notification by email when the Form 1099-R is available online. Visit www.ipers.org/myaccount to learn more about My Account, including instructions for logging in.

In early 2025 IPERS is transitioning to digital delivery and will discontinue mailing most documents. However, IPERS will continue to mail the Form 1099-R to all recipients.

Receiving more than one Form 1099-R

You will receive a separate Form 1099-R for each kind of income you earned. For example, if you received income from an IPERS retirement benefit and a private individual retirement account (IRA), you will receive one Form 1099-R from IPERS and another from the provider of your IRA. You could also receive multiple Form 1099-Rs from IPERS if you:

- Received multiple benefits from IPERS, including retirement, death or disability benefits.

- Received your own retirement benefit and a payment resulting from a divorce.

- Received a benefit and a refund of contributions in the same tax year.

- Turned age 59.5 during the tax year. You will receive one 1099-R with a distribution code of 2 and another with a distribution code of 7; you will need to use both when you file.

Form 1099-R guidelines

Visit the IRS’ website for more information

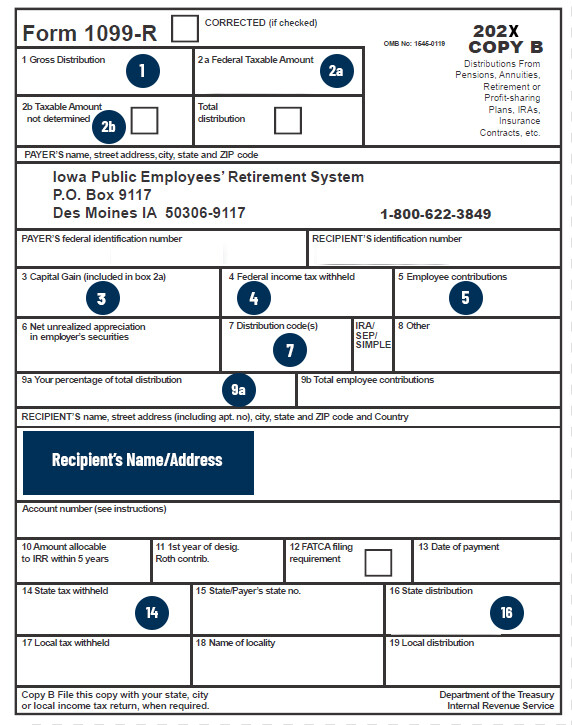

| Box | Details |

|---|---|

| 1 Gross Distribution | The total amount IPERS paid you during the tax year. |

| 2a Taxable amount | The taxable portion of Box 1. If this box is empty, see 2b. |

| 2b Taxable amount not determined | If this box is checked, IPERS did not have all the information needed to calculate your taxable amount. See IRS publication 575, Pension and Annuity Income. |

| 2b Total distribution | If this box is checked, the distribution you received closed your account. |

| 3 Capital Gain | If you received a lump-sum distribution, and were born before January 2, 1936 (or you are the beneficiary of someone born before January 2, 1936,) and you made contributions to IPERS before 1974, you may be able to elect to treat this amount as a capital gain. |

| 4 Federal income tax | The total amount of federal income tax withheld during the tax year. |

| 5 Employee contributions | Any after-tax contributions returned to you, free of taxes, as part of your benefits. Examples of after-tax contributions include work done prior to 1997 or an IPERS service purchase paid with a personal check. The nontaxable amount of benefits you received in the tax year (the difference between Box 1 and Box 2a). If you have previously taxed contributions in your IPERS account, IPERS uses a cost recovery method to amortize the nontaxable dollar amount each year and reports it in Box 5. If Box 5 is blank and there is an "X" in Box 2b, you must determine the nontaxable portion of your annual benefit. |

| 7 Distribution code | The code applicable to your distribution based on IRS guidelines. IPERS common codes: 1 - Early distribution under age 55 2 - Early distribution between the ages of 55 and 59.5 with or without disability 3 - Under age 55 and disabled 4 - Death benefit 7 - Over age 59.5 with or without disability G - Rollover to an IRA or a Roth IRA A - Income averaging (will be combined with codes 4 and 7) |

| 9a Your percentage of total distribution | If a total distribution was made to more than one person, the percentage received is shown here. Note: Percentages of 100% are not shown. |

| 14 State tax withheld | The total amount of state income tax withheld during the tax year. |

| 16 State distribution | Total state taxable benefit. |